Endorsement of the Recommendations of the Task Force on Climate-related Financial Disclosures (TCFD Recommendations)

(Climate-related disclosure based on TCFD Recommendations)

We hereby agree with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD Recommendations) and declare our intention to promote measures to address climate change issues.

We established the "Company-wide Environmental Management Policy in 2025" as follows, under which we are carrying out environmental initiatives.

Company-wide environmental management policy in 2025

As part of our company-wide Environmental Management Policy for 2025, we aim to realize a sustainable society by promoting environmentally friendly business activities and by preserving and protecting the environment.

- We commit ourselves to environmental conservation.

- We work to promote Carbon Neutrality.

- We will continue and extend the work we do on recycling and saving resource.

The Japanese government declared its aim to achieve climate neutrality in 2020, thereby increasing the need for corporate management to shift to decarbonization. Meanwhile, due to the revisions to the Corporate Governance Code [1] in June 2021, the Tokyo Stock Exchange's Prime Market-listed companies are required to disclose information according to the TCFD Recommendations. Furthermore, they are called on to disclose information in accordance with the TCFD Recommendations in their security reports from the financial year ending in March 2023. Given the rising need to enact climate-related measures and the importance of disclosure, we are disclosing climate-related information according to the TCFD recommendations. We will also update our disclosures in accordance with the trends of standards such as IFRS S2 [2] and SSBJ [3].

Core Elements recommended for Disclosure in the TCFD Recommendations

- 1.^A summary of the main principles of corporate governance (a system for companies to make transparent, fair, prompt, and purposeful decisions based on the perspectives of shareholders, customers, employees, local communities, and other stakeholders) as set forth by the Tokyo Stock Exchange.

- 2.^Climate-related disclosure standards issued by the International Sustainability Standards Board (ISSB) in a manner consistent with TCFD Recommendations for disclosure.

- 3.^Sustainability Standards Board of Japan. Responsible for coordinating with the development of international sustainability disclosure standards and developing domestic sustainability disclosure standards such as ISSB.

Governance

We have established a governance system for climate change[5] in order to reflect the climate-related risks and opportunities [4] in our management strategy and business activities.

■The role of management in assessing and managing climate-related risks and opportunities

We define climate change as an important domain, and have established a Carbon Neutrality Promotion Committee to discuss climate change related issues, with the Managing Executive Officer as chairperson and the other Executive Officers as members. The Carbon Neutrality Promotion Committee (secretariat: the manager of the Environmental Business Department and the manager of the Construction & Production Business Planning Office) compiles and discusses reports on basic policies and important issues related to climate change from each division, and reports to the Executive Committee and to the President and Representative Director for further deliberations. The Committee also reports important issues to the Management Committee and Board of Directors for deliberations.

■Oversight by the Board of Directors on climate-related risks and opportunities

Important issues related to climate change are reported to the Board of Directors at least once per year after being passed by the President and Representative Director and the Management Committee. The Board of Directors makes and monitors important business decisions, including those on climate change.

Governance system for climate change

- 4.^Refers to transition risks and opportunities that arise as a result of transitioning to a low carbon economy when climate measures are carried out proactively, and physical risks and opportunities brought about by an increase in the frequency and severity of floods, severe storms, and other disasters when climate measures are inadequate. See Strategy for details.

- 5.^A management system for addressing climate change company-wide, and that positions climate change-related initiatives as important issues.

Strategy

While we are already taking action to address climate change under our Company-wide Environmental Management Policy in 2024, we are also working to identify risks and opportunities that may impact our business activities to prepare for situations that may occur in the future. Moving forward, we will assess the financial risks and opportunities presented by climate change scenarios that are expected in the future to be reflected in our company's management.

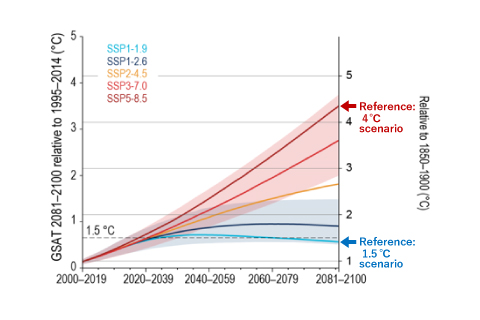

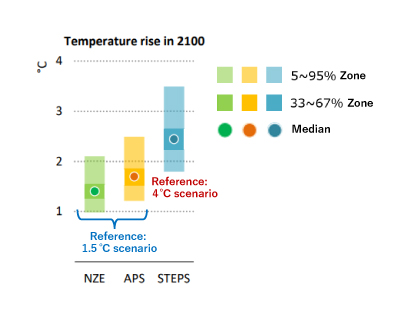

■Expected Scenarios

Climate change is a phenomenon that will unfold over the mid to long term. Therefore, we must envision multiple temperature rise scenarios, identify and evaluate the risks and opportunities, and take measures. This analysis used a scenario under which temperatures rise by 1.5°C by 2100 over temperatures at the start of the industrial revolution after the implementation of a variety of climate mitigation measures, and another scenario under which the current use of fossil fuels continues, and temperatures rise by 4°C. Each scenario was designed based on public documents released by the IPCC [6] and IEA [7].

| Expected Scenarios | Worldview | Key Reference Materials |

|---|---|---|

| 1.5°C Scenarios | A world in which each country carries out a variety of mitigation measures to achieve net zero CO2 emissions by 2050 | ・IPCC[6] SSP1-1.9 ・IEA[7] Net Zero Emissions by 2050 Scenario(NZE) ・IEA Announced Pledges Scenario(APS) |

| 4°C Scenarios | A world where the current use of fossil fuels continues and no mitigation measures are taken | ・IPCC SSP5-8.5 ・IEA Stated Policies Scenario(STEPS) |

- 6.^Intergovernmental Panel on Climate Change. An intergovernmental organization established to provide a scientific basis for the climate change policies of the national governments of each country.

- 7.^International Energy Agency. An organization established for oil consuming countries to cooperate on energy security.

Summary of Key Reference Materials

- IPCC SSP1-1.9

A scenario in which climate mitigation measures are adopted to keep the rise in temperature to 1.5°C or less under sustainable development, to achieve a net zero in CO2 emissions by 2050 - IPCC SSP5-8.5

A scenario in which no climate mitigation measures are adopted under fossil fuel-dependent development. - IEA Net Zero Emissions by 2050 Scenario(NZE)

A net-zero emissions scenario that meets the primary elements of the United Nations sustainable development targets on energy - IEA Announced Pledges Scenario(APS)

A scenario that assumes that the climate change commitments of each nation’s government are fulfilled completely and on time - IEA Stated Policies Scenario(STEPS)

An existing policy scenario that reflects current policies and assumes no additional policies are implemented

Projected temperature rises under each scenario

■Risks and Opportunities

Climate-related risks are generally categorized into transition risks that arise as a result of transitioning to a low carbon economy when climate measures are carried out proactively, and physical risks brought about by an increase in the frequency and severity of floods, severe storms, and other disasters when climate measures are inadequate. In addition to these two types of risks, we are also identifying, analyzing, and assessing opportunities caused by climate change, such as expanded demand or advancement of new business. With regard to the assessment of financial impacts, we have assessed the impact for FY2030 given that there is abundant accessible data, such as public future forecast models, and because it is easy to compare with internal business plans. “Time of Onset” refers to the timing at which the impact of risks and opportunities emerge, and we have defined and categorized these as short term: within 3 years; mid term: by 2030; and long term: by 2050. Based on our sales for the impact on sales and our ordinary income for the impact on costs, we have categorized financial impact as small: up to 2%; medium: 2% to 10%; and large: 10% or more.

Transition risks (that arise as a result of transitioning to a low carbon economy)

| Category | Item | Description | Scenario | Time of onset | Financial impact | Measures |

|---|---|---|---|---|---|---|

| Policies and regulations | Carbon price |

|

1.5°C | Mid term | Medium |

|

|

1.5°C | Mid term | Large | |||

| Compliance with GHG emission regulations |

|

1.5°C | Mid term | Large | ||

| Technology | Spread of renewable energy and energy-saving technologies |

|

1.5°C | Mid term | Small |

|

| Market | Energy demand trends |

|

1.5°C | Mid term | Small |

|

| Price fluctuation of important products and commodities |

|

1.5℃ | Mid term | Small | ||

|

1.5°C | Mid term | Medium | |||

| Reputation | - |

|

1.5°C | Mid term | Medium |

|

Physical risks (brought about by increased frequency and severity of floods, storms, etc.)

| Category | Item | Description | Scenario | Time of onset | Financial impact | Measures |

|---|---|---|---|---|---|---|

| Chronic risks | Average temperature increase |

|

4°C | Mid term | Medium |

|

|

4°C | Short term | Medium | |||

|

4°C | Mid term | Large | |||

| Changes in precipitation and weather patterns |

|

4°C | Mid term | Small |

|

|

| Acute risks | Intensification of extreme weather |

|

4°C | Mid term | Medium |

|

|

4°C | Mid term | Small |

Opportunities

| Category | Item | Description | Scenario | Time of onset | Financial impact | Measures |

|---|---|---|---|---|---|---|

| Resource efficiency | Optimization of production/logistics processes |

|

1.5°C 4℃ |

Mid term | Medium |

|

| Energy | Use of new technologies |

|

1.5°C | Mid term | Medium |

|

| Products/Services | Development, expansion of low carbon products/services |

|

1.5°C | Mid term | Small |

|

|

1.5°C | Short term | Small | |||

|

1.5°C 4℃ |

Mid term | Medium | |||

| New product/service development through R&D and innovation |

|

1.5°C | Mid term | Small |

■Current initiatives

Here we introduce the measures we are already implementing to address three particularly impactful issues from among the risks and opportunities identified.

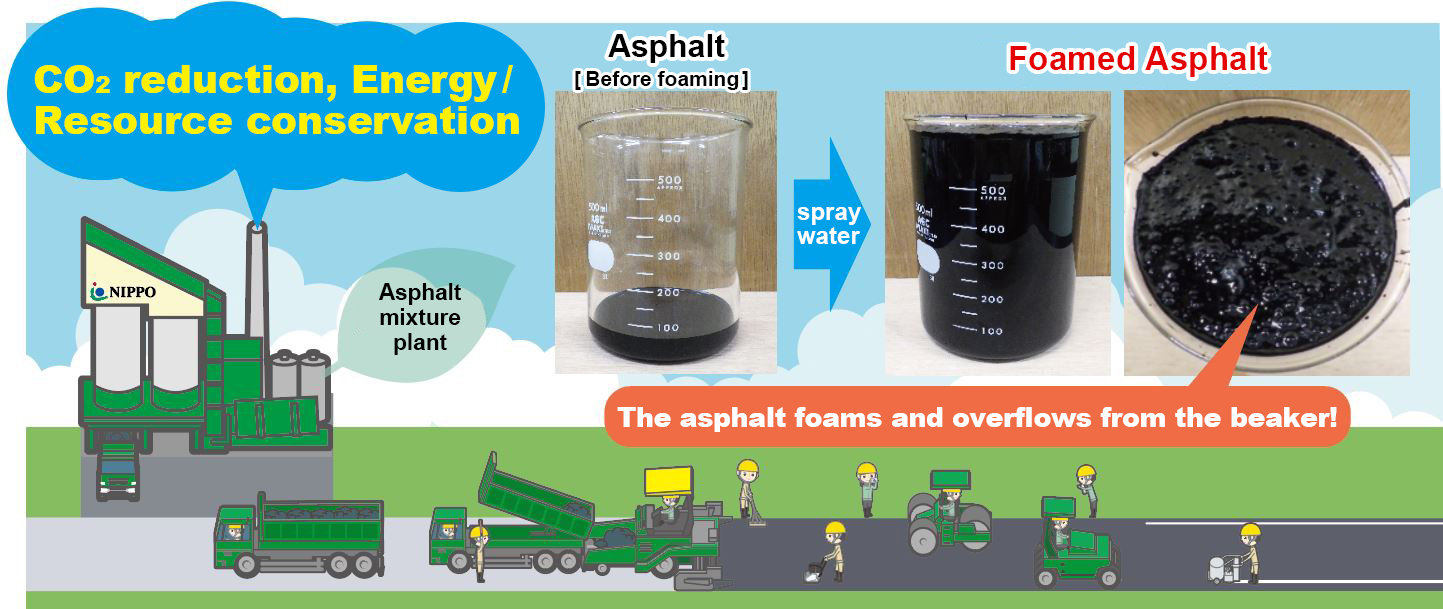

(1) Reducing CO2 emissions during asphalt mixture manufacturing (risk: taxes on CO2 emissions from business activities will increase, causing business expenses to rise)

We have already shifted to CO2 free electricity sources to reduce CO2 emissions.

We are also proactively installing energy conserving facilities and equipment, with energy conserving high efficiency burners adopted at a total of 116 asphalt mixture manufacturing plants as of the end of FY2022.

Furthermore, we have introduced ECO-foamed Warm Mix Asphalt technology that lowers the temperature at which asphalt mixtures are produced by using mechanical foamed asphalt equipment, thereby reducing fossil fuel consumption during the production of those mixtures, which further reduces CO2 emissions.

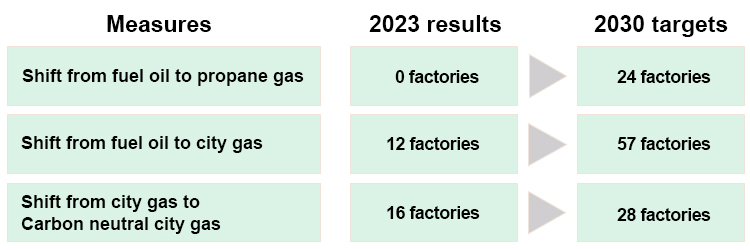

(2) Fuel transition (risk: adoption of renewable energy and new energy sources required to achieve carbon neutrality due to tighter emissions caps, causing a rise in manufacturing expenses.)

We are moving forward with a transition of fuel used at asphalt mixture plants from fuel oils to city gas, and some plants have already adopted carbon neutral city gas.

(3) Development of surfacing technology capable of withstanding extreme weather conditions (risk: Difficult to secure product quality able to withstand severe climate conditions)

In addition to the development of PERFECT COOL, a solar heat blocking pavement that reduces road surface temperature, and COOL POLYSEAL, a water retaining pavement, both technologies reduce CO2 emissions by preventing surface deformation from rising temperatures and increasing pavement durability, we also have technologies that increase the durability of the paving itself, such as POLYSEAL LC, PET REPET PAVE, and HARDASCON.

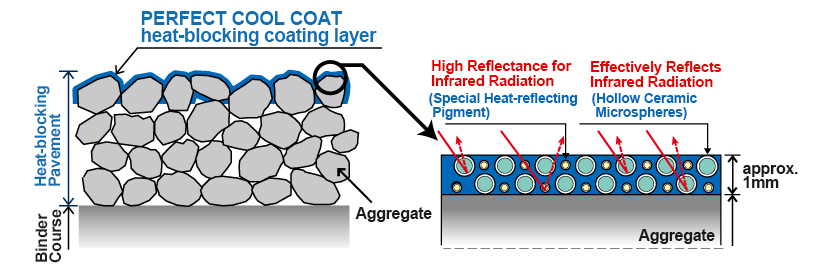

Solar heat blocking pavement (PERFECT COOL)

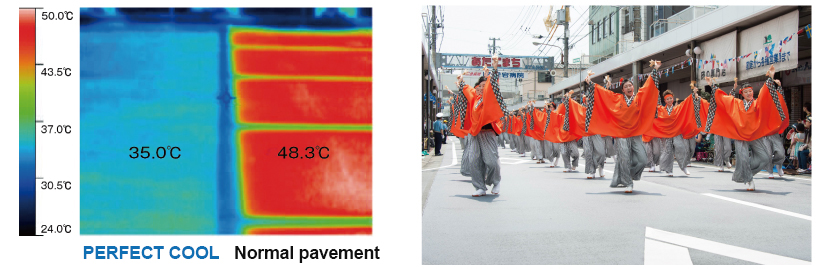

Asphalt pavement reaches temperatures in excess of 60°C during the summer when hit by strong sunlight. PERFECT COOL is highly reflective against the infrared rays in sunlight, limiting the rise in road surface temperature, and increasing the durability of the pavement. This technology won the Global Road Achievement Award from the International Road Federation (IRF) in 2009 and the Best Innovation Award from the World Road Association (PIARC) in 2011.

Right: Example installation of a Perfect Cool coat (road: Kochi City, Kochi Prefecture)

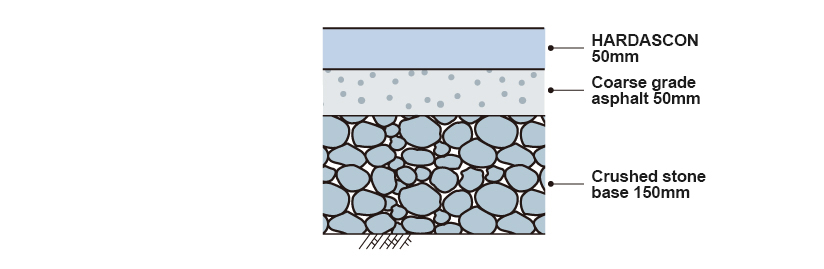

High durability pavement (Hard AsCon)

Hard AsCon is a surfacing technology that adds epoxy resin to the asphalt mixture to increase the mixture’s durability. It achieves longer road lifespan in high temperature environments.

We are moving forward with the development of new technologies and construction methods in anticipation of harsher natural environments in the future.

Risk Management

We believe that climate-related risks have a major impact on management strategies and business activities, and we have integrated climate-related risks into the organization's overall risk management system.

■Process by which the organization identifies, assesses, and manages climate-related risks

The Carbon Neutrality Promotion Committee identifies climate-related risks in each business division, assesses their impact on business, and manages such risks.

■Integration of identification, assessment, and management processes into overall risk management

Particularly important risks are reported to the Board of Directors via the President and Representative Director and the Management Committee, and they are managed comprehensively along with other risks that can have a significant impact on this company’s business. The board discusses measures to avoid risks and to minimize the impact when they emerge, and makes decisions.

Metrics and Targets

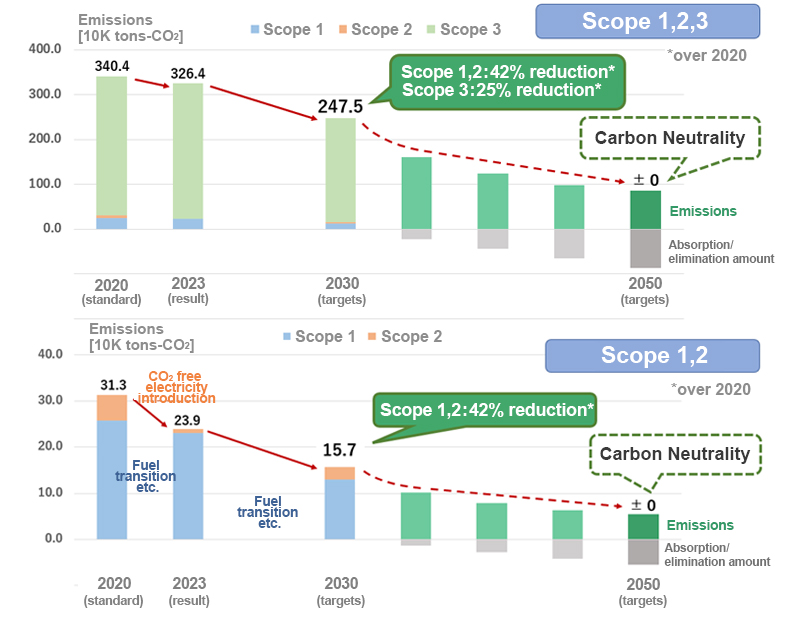

We monitor and manage CO2 emissions as an indicator and target for responding to climate-related risks and opportunities.

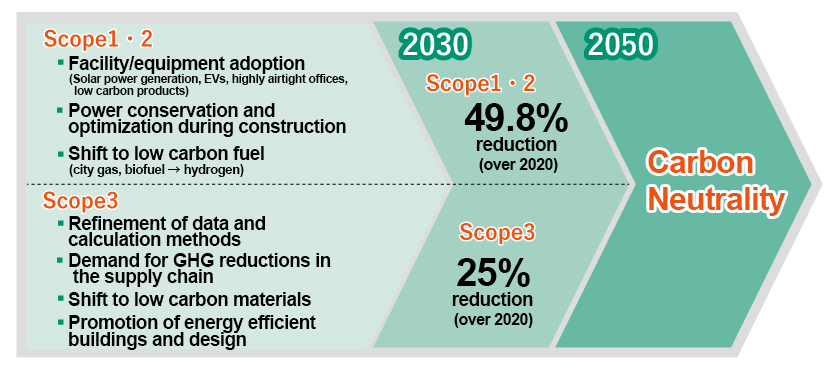

We are working to reduce emissions, with targets including a 49.8% reduction over 2020 levels by 2030 under Scope 1 and 2, and a 25% reduction over 2020 levels by 2030 under Scope 3.

We believe that we must tackle Scope 1 and 2 first because these represent our own CO2 emissions, for which we have an important responsibility, and reduction measures can greatly contribute to reducing emissions. In order to achieve Scope 2 reductions, we are currently transitioning the power sources used in our offices to CO2 free electricity in all of our offices for which transition is possible. We are also planning and implementing a transition from fuel oil to city gas as part of our activities to achieve Scope 1 reductions. We will continue to move forward with measures to reduce CO2 emissions toward our 2030 target.

Revision 1: May 19, 2025 – Updated CO₂ emissions, reduction achievements, and targets in accordance with SBT certification.

Initial Version:November 1, 2024